It is no secret that the Fed, Bank of England, Bank of Japan and the Swiss national Banks are going to provide dollars to European banks that are the victims of American lenders who have pulled their funds out of Europe for fear of losing their investments. They are phasing out an orderly fashion. The commitments of these central banks are doing three things putting their citizens at more financial risk; driving inflation higher; aiding in the increase in gold prices and following a path they already know is doomed to failure. The players did not want a replay of the Lehman Affair of just three years ago, or the ongoing immediate consequences. Everyone wanted to look like they were in motion, that they were doing something about the problem. The underlying problem is that banks in Europe cannot issue much more debt or they will look like bigger fools than they already are. Due to the banks poor choices in the past these banks are on the edge of failure and were Greece to default they’d get closer to the edge. If all insolvent nations were to default these banks would all go under. Thus, we see another bank bailout engineered by the Fed and other central banks. As this new crisis unfolds the European and world economies are slowing down, which will compound problems.

Giorgio Bertini

Research Professor on society, culture, art, cognition, critical thinking, intelligence, creativity, neuroscience, autopoiesis, self-organization, complexity, systems, networks, rhizomes, leadership, sustainability, thinkers, futures ++

Networks

Learning Change Project

Categories

500 Posts in this Blog

- Follow Learning Political Economy on WordPress.com

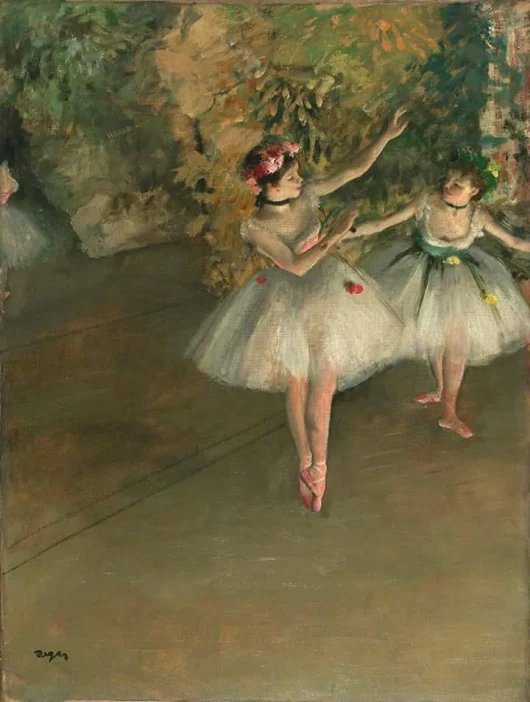

Edgar Degas